Liberty Gold Confirms Robust Gold Leach Recoveries at Black Pine

85.2% weighted average gold extraction in Rangefront Zone (7 columns)

80.5% weighted average gold extraction in Discovery Zone (15 columns)

VANCOUVER, British Columbia, Sept. 24, 2025 (GLOBE NEWSWIRE) -- Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold” or the “Company”) is pleased to report results from its Phase 5B metallurgical program at the Company’s Black Pine Oxide Gold Project (“Black Pine”) in southeast Idaho. The new results confirm consistent, predictable gold recoveries across the primary ore bodies at Black Pine, further supporting a low cost, run-of-mine (“ROM”) heap leach processing flowsheet.

Highlights

-

Consistent Gold Extractions and Leach Performance: Weighted average column leach gold extraction of 81.9% at an average head grade of 0.65 parts per million (“ppm”) gold (“Au”), with individual composites ranging from 52% to 94.5%. Phase 5B composites exhibit the typical Black Pine leach result of greater than 80% of the eventual gold extraction achieved in under 10 days.

- The feasibility recovery model has been updated with these new results and shows gold recoveries in line or slightly better than previous results across Rangefront and Discovery Zones.

-

Corroborated Bottle Roll Data: Gold extractions from direct leach coarse crush bottle rolls (P80 of 1.68 millimeters (“mm”)) are aligned with column leach results (P80 of 16.9mm) at 78.4% vs 81.9%, respectively.

- This relationship further validates that gold leaching at Back Pine is highly insensitive to crush size.

-

Confirmation of Recovery in Primary Mining Phases: Phase 5B testing focused on infill sampling within the primary mining phases of Rangefront and Discovery Zones.

- Feasibility level metallurgical work will be completed in H1, 2026. It is anticipated that with resource growth at Rangefront, additional test work may be required to achieve variability coverage.

See https://vrify.com/decks/20140 for a dynamic 3D view of the composite sample locations from the comprehensive metallurgical program across the Black Pine Oxide Gold Project.

Jon Gilligan, President and CEO, Liberty Gold, commented, “We are nearing completion of our comprehensive metallurgical program at Black Pine. Column gold extractions of 80 to 90 percent with rapid leach kinetics underscore the significant potential of this oxide gold asset. These results also confirm Rangefront as the premier leaching ore at Black Pine with up to a 10 percent recovery improvement over the Discovery zone. We look forward to further results from the bulk sample, large diameter columns and the ongoing work at Rangefront as it grows to potentially become the most significant gold mineralized zone at Black Pine.”

Phase 5B Metallurgical Test Summary

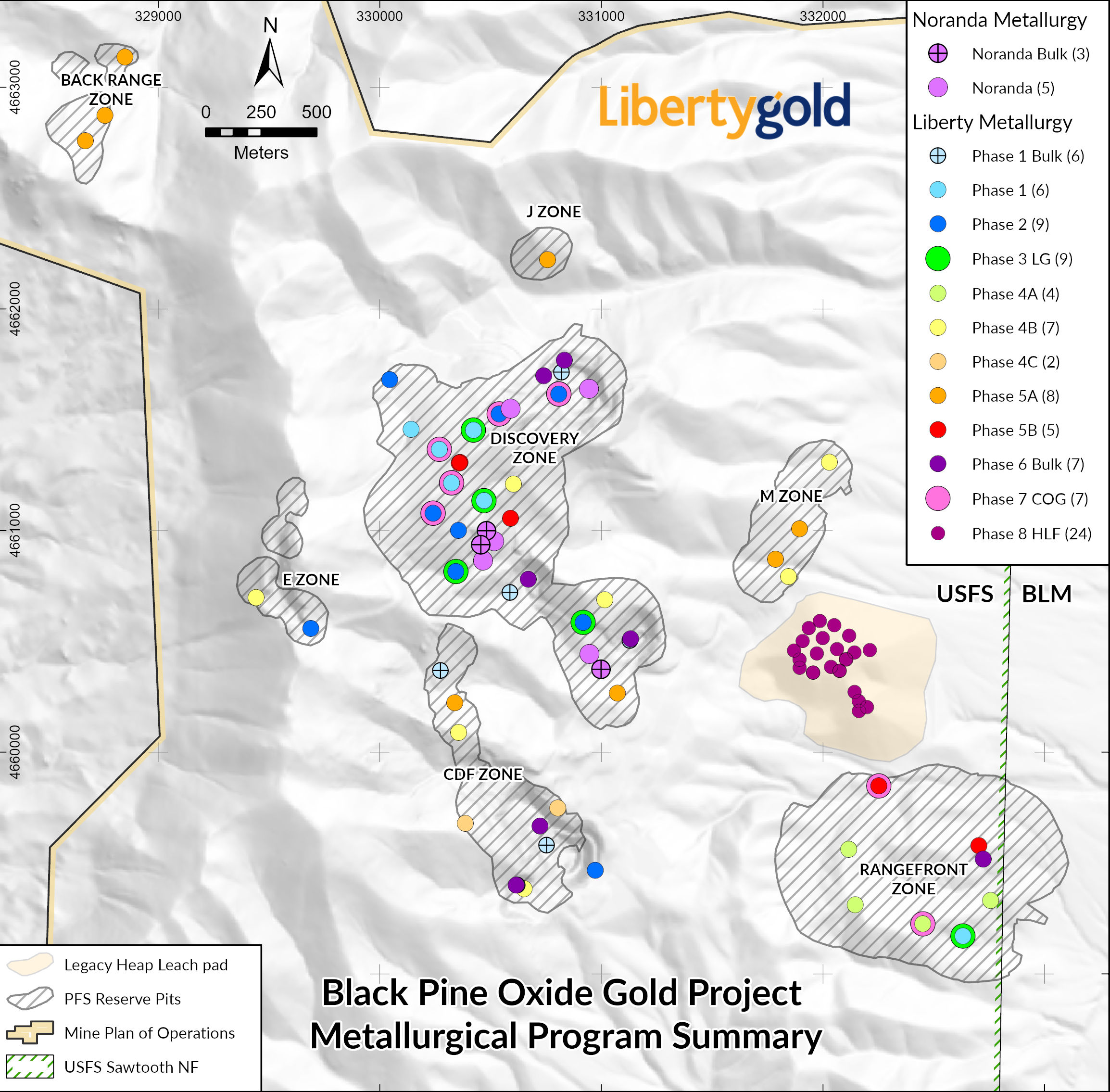

The Phase 5B program was designed to improve sample coverage in the main deposit areas and confirm consistency of gold extraction within the main rock types. Figure 1 below illustrates drill locations for the Phase 5B variability composite metallurgical core holes. Metallurgical composites were made up from PQ sized core drilled in 2023. A total of 22 column leach tests were completed in Phase 5B, under standard test conditions for Black Pine oxide gold material, with results summarized below in Table 1.

Figure 1 – Summary Map of Black Pine Metallurgical Program Sample Locations

Table 1 – Weighted Average Gold Extraction Results by Zone – Coarse Bottle Roll and Column Leach Tests

| Coarse Bottle Roll | Column Leach Tests | |||

|

Feed Target P80 (1.7 mm) |

Average P80 (16.9 mm) | |||

| Zone | Average Calculated Head Grade Au (ppm) |

Weighted Average Direct Leach Bottle Roll Au Extraction (%) |

Average Calculated Head Grade Au (ppm) |

Average Column Leach Au Extraction (%) |

| Rangefront | 0.61 | 85.0% | 0.58 | 85.2% |

| Discovery | 0.71 | 75.7% | 0.68 | 80.5% |

| All Zones | 0.68 | 78.4% | 0.65 | 81.9% |

Notes: Average Calculated Head Grade is the average of the composite bottle roll or column head grades tested within each zone. Detailed sample-level results are provided in Table 2 below.

Silver

Column leach tests showed silver (“Ag”) extractions up to 68.1%, with an average of 19%. These silver grades and extractions are in line with previous results.

Interpretation

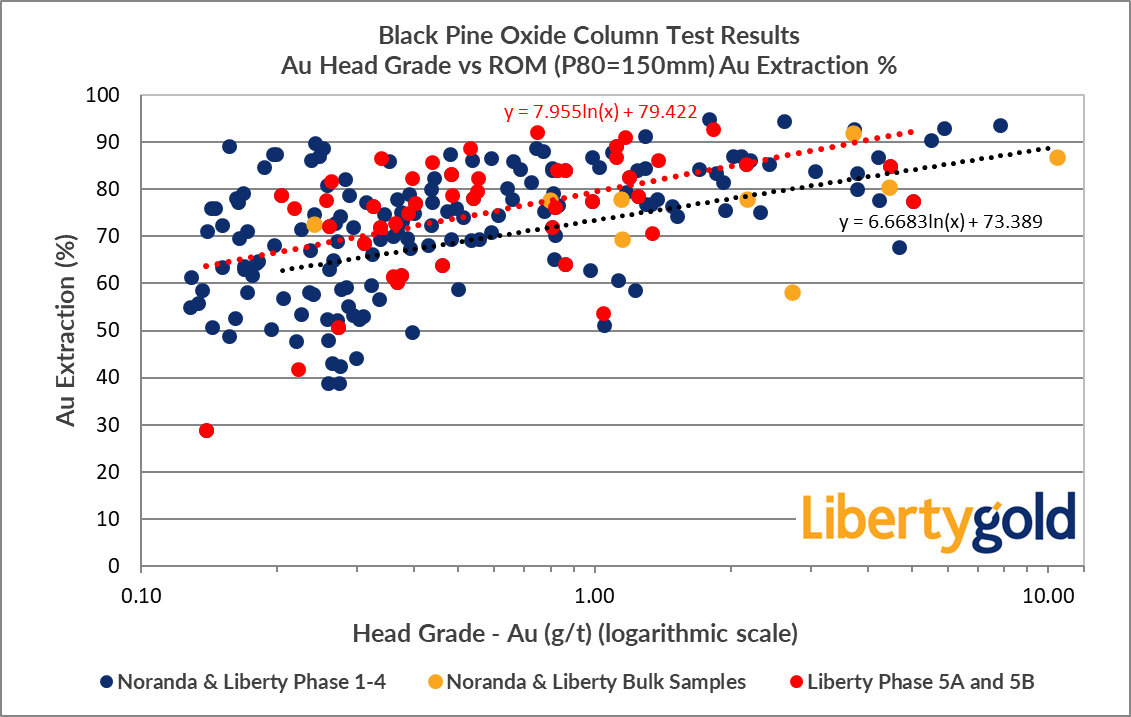

- Phase 5B gold extractions are in line with or slightly better than previous metallurgical testing results from both Discovery and Rangefront Zones, verifying strong recovery in the two largest mining phases at Black Pine (Figure 2).

Figure 2 – Grade vs. extraction for Phase 5A and 5B results

The consistent correlation between bottle roll and column leach data continues to reinforce that gold extraction is insensitive to particle size. This insensitivity supports the feasibility of low-cost, ROM leach processing for Black Pine oxide ores.

Ongoing Metallurgical Programs

Liberty Gold has an ongoing feasibility-level metallurgical program for Black Pine:

-

Phase 6: Seven (Six in-pit and one surface) 20 tonne ROM surface bulk samples sourced from the main mineralized lithology types, are being tested in Pilot-Scale columns (4 feet diameter x 20 feet high) at Kappes, Cassiday & Associates (“KCA”) in Reno.

- Three bulk samples are currently under leach and the remaining four are in preparation. Results are expected in H1 2026.

-

Phase 7: Nine cut-off grade variability composites currently under column leach. These tests are to verify gold extraction at the lowest end of the grade/recovery curve in the current recovery model.

- Leaching of these columns will be completed in September and reported in Q4, 2025.

-

Phase 8: 24 sonic drill holes (~1,400 meters) have been completed in the legacy heap leach pad, with initial gold assays received. This material will be tested for the potential to act as over-liner material and also as direct leach feed.

- Metallurgical composites have been shipped to Newfields and Forte Dynamics and test work will begin late in Q3 2025.

These programs are designed to finalize predicted gold leach recoveries and optimize process design criteria as inputs to the Feasibility Study targeted for completion in Q4 2026. Additional phases of metallurgical work are being evaluated for improved recovery model precision going into detailed mine/process design and eventual production.

Table 2 – Phase 5B Gold Extraction Results

| Coarse Bottle Roll | Column Leach Tests | |||

| Feed Target P80 (1.7mm) | Average P80 (16.9mm) | |||

| Zone | Average Calculated Head Grade Au (ppm) |

Weighted Average Direct Leach Bottle Roll Au Extraction (%) |

Average Calculated Head Grade Au (ppm) |

Average Column Leach Au Extraction (%) |

| Rangefront | 0.814 | 93.4 | 0.685 | 94.5 |

| Rangefront | 0.573 | 83.2 | 0.570 | 85.8 |

| Rangefront | 0.217 | 66.3 | 0.252 | 52.0 |

| Rangefront | 0.219 | 75.9 | 0.204 | 77.9 |

| Rangefront | 0.498 | 81.2 | 0.472 | 80.7 |

| Rangefront | 1.439 | 85.5 | 1.318 | 87.0 |

| Rangefront | 0.540 | 87.2 | 0.567 | 90.7 |

| Discovery | 0.250 | 75.3 | 0.237 | 77.6 |

| Discovery | 1.212 | 88.9 | 1.201 | 91.6 |

| Discovery | 0.395 | 73.4 | 0.443 | 82.6 |

| Discovery | 0.483 | 83.9 | 0.450 | 86.0 |

| Discovery | 0.387 | 72.6 | 0.335 | 79.7 |

| Discovery | 0.371 | 57.1 | 0.355 | 61.7 |

| Discovery | 1.090 | 47.4 | 1.031 | 55.5 |

| Discovery | 0.377 | 72.1 | 0.355 | 74.7 |

| Discovery | 1.402 | 66.2 | 1.354 | 72.2 |

| Discovery | 0.634 | 79.1 | 0.587 | 83.3 |

| Discovery | 0.348 | 82.6 | 0.355 | 88.2 |

| Discovery | 0.371 | 54.7 | 0.331 | 64.4 |

| Discovery | 1.908 | 90.3 | 1.779 | 93.5 |

| Discovery | 1.150 | 84.2 | 1.079 | 87.5 |

| Discovery | 0.264 | 77.7 | 0.259 | 83.4 |

| Averages | 0.679 ppm Au | 78.4% | 0.646 ppm Au | 81.9% |

Footnote: ppm = parts per million or grams per tonne (g/t)

Quality Assurance – Quality Control

All metallurgical work at Black Pine was conducted at KCA Labs in Reno and is supervised by Gary Simmons, MMSA, formerly Director of Metallurgy and Technology for Newmont Mining Corp. Mr. Simmons has managed metallurgical programs on multiple Carlin-style oxide deposits in the Great Basin.

Richard Zaggle, SME-RM, Senior Director, Mining and Metallurgy for Liberty Gold, is the Qualified Person responsible for reviewing and approving the technical content of this release.

ABOUT LIBERTY GOLD

Liberty Gold is focused on developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. The Company is advancing the Black Pine Project in southeastern Idaho, a past-producing, Carlin-style gold system with a large, growing resource and strong economic potential. We know the Great Basin and are driven to advance big gold deposits that can be mined profitably in open-pit scenarios and in an environmentally responsible manner.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

info@libertygold.ca

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws, including statements or information concerning, future financial or operating performance of Liberty Gold and its business, operations, properties and condition; planned de-risking activities at Liberty Gold’s mineral properties; the potential quantity, recoverability and/or grade of minerals; the potential size of a mineralized zone or potential expansion of mineralization; proposed exploration and development of Liberty Gold’s exploration property interests; the results of mineral resource estimates or mineral reserve estimates and preliminary feasibility studies; and the Company’s anticipated expenditures.

Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, timely receipt of governmental or regulatory approvals, including any stock exchange approvals; receipt of a financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, the scalability of results of metallurgical testing, results or timing of any mineral resources, feasibility study, environmental impact studies, mineral reserves, or pre-feasibility study; the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; recoveries being inconsistent with metallurgical test results; the timing or results of the publication of any mineral resources, mineral reserves, environmental impact studies or feasibility studies; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing, timing of the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 25, 2025, in the section entitled "Risk Factors", under Liberty Gold’s SEDAR+ profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except for material differences between actual results and previously disclosed material forward-looking information, or as otherwise required by law.

Except for statements of historical fact, information contained herein or incorporated by reference herein constitutes forward-looking statements and forward-looking information. Readers should not place undue reliance on forward-looking information. All forward-looking statements and forward-looking information attributable to us is expressly qualified by these cautionary statements.

Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The information, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “mineral reserves”. These terms are Canadian mining terms as defined in, and required to be disclosed in accordance with, NI 43-101, which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards, adopted by the CIM Council, as amended. However, these standards differ significantly from the mineral property disclosure requirements of the United States Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the United States Securities Act of 1934, as amended. The Company does not file reports with the SEC and is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/3ce9ac65-b207-4876-ac3f-16cd6e74ac2e

https://www.globenewswire.com/NewsRoom/AttachmentNg/df73b611-4b5a-4634-8011-f3d81c62c66c

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.